teamzr1

Supporting vendor

Free train to taxpayers money has left the station

Over the past few years, electric vehicle manufacturing facilities producing lithium batteries, car parts and critical minerals sprang up all over the United States. Drawing on cash and tax credits from the Inflation Reduction Act (Taxpayers money), these factories promised to provide jobs and to set the nation on a path to making homegrown EVs.

But even before President Donald Trump’s sweeping tariffs on imports, many of those projects were being canceled, leaving thousands of jobs and the shift to clean energy in doubt.

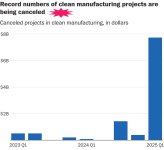

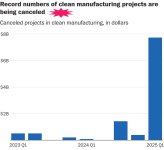

According to data from Atlas Public Policy, a policy research group, more projects were canceled in the first quarter of 2025 than in the previous two years combined.

Those cancellations include a $1 billion factory in Georgia that would have made thermal barriers for batteries and a $1.2 billion lithium-ion battery factory in Arizona.

“It’s hard at the moment to be a manufacturer in the U.S. given uncertainties on tariffs, tax credits and regulations,” said Tom Taylor, senior policy analyst at Atlas Public Policy. Hundreds of millions of dollars in additional investments appear to be stalled, he added, but haven’t been formally canceled yet.

“Nothing is more important to business than market clarity,” said Bob Keefe, executive director of E2, a clean energy advocacy group. “It’s about as clear as a blizzard at midnight.”

The 2022 climate law that Democrats passed was designed to reward automakers for building cars and parts in the United States. Vehicles qualified for a $7,500 tax credit based on their American-made parts and minerals, and companies could get additional cash if they manufactured batteries domestically.

But many of those benefits could be repealed in a new Republican-led tax bill. The Trump administration has also moved to reverse the Biden administration’s rules on car tailpipe pollution. Just those changes, according to a recent report from Princeton University, could cut EV sales in 2030 by 40 percent.

In response, companies that had invested in manufacturing American EV parts are now pulling back and canceling projects. In an earnings call in February, Aspen Aerogels, the company behind the $1 billion factory in Georgia, announced that it was canceling the facility and shifting manufacturing loan existing U.S. factory and to Mexico and China.

“China is at 50 percent EV penetration already,” Ricardo C. Rodriguez, the chief financial officer and treasurer of Aspen Aerogels, said on the call, saying the shift to China was a “no-brainer.” “In North America and Europe, we continue to dabble in this 10 percent to 15 percent level. So, you do start wondering, right, is that progress?”

Aspen Aerogels declined to comment further.

“It’s working-class people in places like Georgia, North Carolina, Kentucky, Michigan and Arizona that have seen some of these projects get canceled,” Keefe said. “And I can tell you who’s benefiting China and other countries that are doubling down.”

Diana Furchtgott-Roth, director of the Center for Energy, Climate, and Environment at the Heritage Foundation, praised Trump’s move to roll back EV regulations. Despite generous federal incentives, she said, many Americans were not buying electric vehicles.

“Costly, mandated EVs make poor people poorer and less safe,” Furchtgott-Roth said.

Taylor Rogers, the White House assistant press secretary, said in an email that the administration’s approach would benefit Americans.

“The President’s brilliant economic agenda is an all-encompassing plan to revive our economy by unleashing American energy, implementing tariffs to level the playing field, and bringing billions of dollars in historic investments to America’s manufacturing sector,” Rogers said.

Some of the companies pulling back also had been seeking loans from the federal government loans that, since the Trump administration, have been paused or put on hold. Battery Non-American maker KORE Power received conditional approval in 2023 for an $850 million loan to build a factory in Arizona. But earlier this year, the company said it had abandoned that plan and would instead retrofit an existing factory.

A company spokesperson told The Post at the time that KORE Power decided to change its plans before Trump took office.

Other projects were closed by EV makers facing tough headwinds and scandal. Nikola Motors and Canoo, both EV start-ups, have filed for bankruptcy in recent months.

Before the closures, the United States was on track for producing almost all the batteries needed for the country’s electric cars and trucks by 2030, according to an analysis from research firm Rhodium Group.

“The EV outlook was already looking pretty bearish before the election,” said Trevor Houser, a partner at Rhodium Group in energy and climate. Compounded with concerns about tariffs and trade, he added, “any downside in the outlook would naturally lead to some battery cancellations.”

Even projects that are moving forward are downplaying or reducing the role of all-electric vehicles. Hyundai’s multibillion-dollar manufacturing plant in Savannah, Georgia, recently announced a switch from making only EVs to also producing hybrids.

There is also a slowdown in new facilities coming online.

According to E2, January saw just $176 million in clean manufacturing projects announced, while a normal month would see around $1 billion in new investments.

“You see a lot of people watching and waiting,” said Jason Grumet, CEO of the American Clean Power Association. “If you don’t know if the inputs to your factory are going to dramatically increase in price, it slows things down.”

The slowdown threatens to stall American EV supply chains before they truly got off the ground. While wind and solar energy have been growing in the United States for years, clean manufacturing needed a bit more of a boost, Houser said. Without help, the sector could slip back into obscurity.

“Everyone’s looking for a silver lining,” Keefe said. “I have a hard time finding it.”

Over the past few years, electric vehicle manufacturing facilities producing lithium batteries, car parts and critical minerals sprang up all over the United States. Drawing on cash and tax credits from the Inflation Reduction Act (Taxpayers money), these factories promised to provide jobs and to set the nation on a path to making homegrown EVs.

But even before President Donald Trump’s sweeping tariffs on imports, many of those projects were being canceled, leaving thousands of jobs and the shift to clean energy in doubt.

According to data from Atlas Public Policy, a policy research group, more projects were canceled in the first quarter of 2025 than in the previous two years combined.

Those cancellations include a $1 billion factory in Georgia that would have made thermal barriers for batteries and a $1.2 billion lithium-ion battery factory in Arizona.

“It’s hard at the moment to be a manufacturer in the U.S. given uncertainties on tariffs, tax credits and regulations,” said Tom Taylor, senior policy analyst at Atlas Public Policy. Hundreds of millions of dollars in additional investments appear to be stalled, he added, but haven’t been formally canceled yet.

“Nothing is more important to business than market clarity,” said Bob Keefe, executive director of E2, a clean energy advocacy group. “It’s about as clear as a blizzard at midnight.”

The 2022 climate law that Democrats passed was designed to reward automakers for building cars and parts in the United States. Vehicles qualified for a $7,500 tax credit based on their American-made parts and minerals, and companies could get additional cash if they manufactured batteries domestically.

But many of those benefits could be repealed in a new Republican-led tax bill. The Trump administration has also moved to reverse the Biden administration’s rules on car tailpipe pollution. Just those changes, according to a recent report from Princeton University, could cut EV sales in 2030 by 40 percent.

In response, companies that had invested in manufacturing American EV parts are now pulling back and canceling projects. In an earnings call in February, Aspen Aerogels, the company behind the $1 billion factory in Georgia, announced that it was canceling the facility and shifting manufacturing loan existing U.S. factory and to Mexico and China.

“China is at 50 percent EV penetration already,” Ricardo C. Rodriguez, the chief financial officer and treasurer of Aspen Aerogels, said on the call, saying the shift to China was a “no-brainer.” “In North America and Europe, we continue to dabble in this 10 percent to 15 percent level. So, you do start wondering, right, is that progress?”

Aspen Aerogels declined to comment further.

“It’s working-class people in places like Georgia, North Carolina, Kentucky, Michigan and Arizona that have seen some of these projects get canceled,” Keefe said. “And I can tell you who’s benefiting China and other countries that are doubling down.”

Diana Furchtgott-Roth, director of the Center for Energy, Climate, and Environment at the Heritage Foundation, praised Trump’s move to roll back EV regulations. Despite generous federal incentives, she said, many Americans were not buying electric vehicles.

“Costly, mandated EVs make poor people poorer and less safe,” Furchtgott-Roth said.

Taylor Rogers, the White House assistant press secretary, said in an email that the administration’s approach would benefit Americans.

“The President’s brilliant economic agenda is an all-encompassing plan to revive our economy by unleashing American energy, implementing tariffs to level the playing field, and bringing billions of dollars in historic investments to America’s manufacturing sector,” Rogers said.

Some of the companies pulling back also had been seeking loans from the federal government loans that, since the Trump administration, have been paused or put on hold. Battery Non-American maker KORE Power received conditional approval in 2023 for an $850 million loan to build a factory in Arizona. But earlier this year, the company said it had abandoned that plan and would instead retrofit an existing factory.

A company spokesperson told The Post at the time that KORE Power decided to change its plans before Trump took office.

Other projects were closed by EV makers facing tough headwinds and scandal. Nikola Motors and Canoo, both EV start-ups, have filed for bankruptcy in recent months.

Before the closures, the United States was on track for producing almost all the batteries needed for the country’s electric cars and trucks by 2030, according to an analysis from research firm Rhodium Group.

“The EV outlook was already looking pretty bearish before the election,” said Trevor Houser, a partner at Rhodium Group in energy and climate. Compounded with concerns about tariffs and trade, he added, “any downside in the outlook would naturally lead to some battery cancellations.”

Even projects that are moving forward are downplaying or reducing the role of all-electric vehicles. Hyundai’s multibillion-dollar manufacturing plant in Savannah, Georgia, recently announced a switch from making only EVs to also producing hybrids.

There is also a slowdown in new facilities coming online.

According to E2, January saw just $176 million in clean manufacturing projects announced, while a normal month would see around $1 billion in new investments.

“You see a lot of people watching and waiting,” said Jason Grumet, CEO of the American Clean Power Association. “If you don’t know if the inputs to your factory are going to dramatically increase in price, it slows things down.”

The slowdown threatens to stall American EV supply chains before they truly got off the ground. While wind and solar energy have been growing in the United States for years, clean manufacturing needed a bit more of a boost, Houser said. Without help, the sector could slip back into obscurity.

“Everyone’s looking for a silver lining,” Keefe said. “I have a hard time finding it.”